This article is being updated, please refresh later for more content.

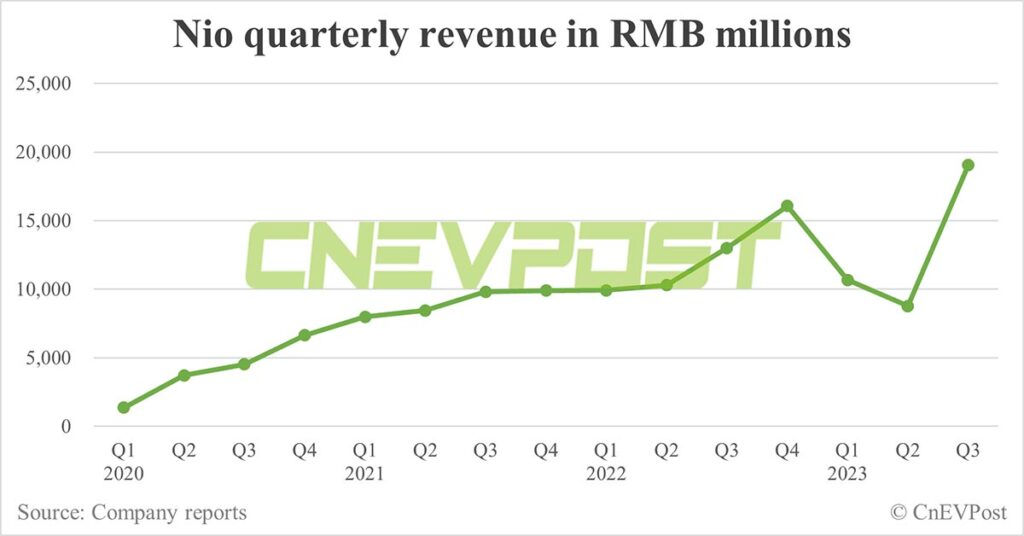

Nio (NYSE: NIO) reported third-quarter revenue of RMB 19.07 billion, up 46.64 percent year-on-year and 117.36 percent from the second quarter.

Its net loss for the third quarter was RMB4.557 billion, up 10.8 percent from the third quarter of 2022 and down 24.8 percent from the second quarter of 2023.

Excluding equity incentive expenses, its adjusted net loss for the third quarter was RMB3,950 million, an increase of 13.0 percent from the third quarter of 2022 and a decrease of 27.4 percent from the second quarter of 2023.

Financial Results for the Third Quarter of 2023

Revenues

Total revenues in the third quarter of 2023 were RMB19,066.6 million (US$2,613.3 million), representing an increase of 46.6% from the third quarter of 2022 and an increase of 117.4% from the second quarter of 2023.

Vehicle sales in the third quarter of 2023 were RMB17,408.9 million (US$2,386.1 million), representing an increase of 45.9% from the third quarter of 2022 and an increase of 142.3% from the second quarter of 2023. The increase in vehicle sales over the third quarter of 2022 and the second quarter of 2023 was mainly attributable to higher vehicle deliveries.

Other sales in the third quarter of 2023 were RMB1,657.7 million (US$227.2 million), representing an increase of 55.0% from the third quarter of 2022 and an increase of 4.5% from the second quarter of 2023. The increase in other sales over the third quarter of 2022 was mainly due to the increase in sales of accessories, used cars, and provision of power solutions, as a result of continued growth in the number of our users.

The increase in other sales over the second quarter of 2023 was mainly due to the increase in sales of accessories, charging piles, and provision of power solutions, as a result of continued growth in the number of our users, partially offset by a decrease in revenue from sales of used cars.

Cost of Sales and Gross Margin

Cost of sales in the third quarter of 2023 was RMB17,543.2 million (US$2,404.5 million), representing an increase of 55.7% from the third quarter of 2022 and an increase of 102.0% from the second quarter of 2023.

The increase in cost of sales over the third quarter of 2022 was mainly driven by the increase in vehicle deliveries, provision of power solutions, sales of used cars and accessories, partially offset by the lower battery cost per unit.

The increase in cost of sales over the second quarter of 2023 was mainly attributable to the increase in vehicle deliveries, provision of power solutions and sales of charging piles, partially offset by decreased volume of used cars sold.

Gross profit in the third quarter of 2023 was RMB1,523.3 million (US$208.8 million), representing a decrease of 12.2% from the third quarter of 2022 and an increase of 1,650.9% from the second quarter of 2023.

Gross margin in the third quarter of 2023 was 8.0%, compared with 13.3% in the third quarter of 2022 and 1.0% in the second quarter of 2023. The decrease of gross margin over the third quarter of 2022 was mainly attributable to the decreased vehicle margin. The increase of gross margin over the second quarter of 2023 was mainly attributable to the increased vehicle margin.

Vehicle margin in the third quarter of 2023 was 11.0%, compared with 16.4% in the third quarter of 2022 and 6.2% in the second quarter of 2023.

The decrease in vehicle margin from the third quarter of 2022 was mainly attributable to changes in product mix, partially offset by the decreased battery cost per unit. The increase in vehicle margin from the second quarter of 2023 was mainly due to changes in product mix, as well as decreased promotion.

Operating Expenses

Research and development expenses in the third quarter of 2023 were RMB3,039.1 million (US$416.5 million), representing an increase of 3.2% from the third quarter of 2022 and a decrease of 9.1% from the second quarter of 2023.

Excluding share-based compensation expenses, research and development expenses (non-GAAP) were RMB2,643.2 million (US$362.3 million), representing an increase of 2.8% from the third quarter of 2022 and a decrease of 10.2% from the second quarter of 2023.

The slight increase in research and development expenses over the third quarter of 2022 was mainly attributable to the increased personnel costs in research and development functions, partially offset by the decreased design and development costs and deduction of expenses due to the support for technology advancement provided by local governmental authorities during the third quarter of 2023.

The decrease in research and development expenses over the second quarter of 2023 was mainly due to the support for technology advancement provided by local governmental authorities during the third quarter of 2023.

Selling, general and administrative expenses in the third quarter of 2023 were RMB3,609.3 million (US$494.7 million), representing an increase of 33.1% from the third quarter of 2022 and an increase of 26.3% from the second quarter of 2023.

Excluding share-based compensation expenses, selling, general and administrative expenses (non-GAAP) were RMB3,423.8 million (US$469.3 million), representing an increase of 37.5% from the third quarter of 2022 and an increase of 28.1% from the second quarter of 2023.

The increase in selling, general and administrative expenses over the third quarter of 2022 and the second quarter of 2023 was mainly attributable to (i) the increase in personnel costs related to sales functions, and (ii) the increase in sales and marketing activities, including the launch of new products.

Loss from Operations

Gain on extinguishment of debt in the third quarter of 2023 were RMB170.2 million (US$23.3 million), compared with nil in the third quarter of 2022 and second quarter of 2023, which was attributable to gain from repurchase of a portion of our 0.00% convertible senior notes due 2026 and repurchase of a portion of our 0.50% convertible senior notes due 2027 with the carrying amount of RMB1,822.0 million (US$253.8 million) and RMB1,739.3 million (US$242.2 million), respectively, in the third quarter of 2023.

Loss from operations in the third quarter of 2023 was RMB4,843.9 million (US$663.9 million), representing an increase of 25.2% from the third quarter of 2022 and a decrease of 20.3% from the second quarter of 2023.

Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB4,240.4 million (US$581.2 million) in the third quarter of 2023, representing an increase of 30.1% from the third quarter of 2022 and a decrease of 22.4% from second quarter of 2023.

Net Loss and Earnings Per Share/ADS

Net loss in the third quarter of 2023 was RMB4,556.7 million (US$624.6 million), representing an increase of 10.8% from the third quarter of 2022 and a decrease of 24.8% from the second quarter of 2023.

Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB3,953.2 million (US$541.8 million) in the third quarter of 2023, representing an increase of 13.0% from the third quarter of 2022 and a decrease of 27.4% from the second quarter of 2023.

Net loss attributable to NIO’s ordinary shareholders in the third quarter of 2023 was RMB 4,628.6 million (US$634.4 million), representing an increase of 11.7% from the third quarter of 2022 and a decrease of 24.4% from the second quarter of 2023.

Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB 3,947.9 million (US$541.1 million) in the third quarter of 2023.

Basic and diluted net loss per ordinary share/ADS in the third quarter of 2023 were both RMB2.67 (US$0.37), compared with RMB2.53 in the third quarter of 2022 and RMB3.70 in the second quarter of 2023.

Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per share/ADS (non-GAAP) were both RMB2.28 (US$0.31), compared with RMB2.11 in the third quarter of 2022 and RMB3.28 in the second quarter of 2023.

Balance Sheet

Balance of cash and cash equivalents, restricted cash, short-term investment and long-term time deposits was RMB45.2 billion (US$6.2 billion) as of September 30, 2023.

Business Outlook

For the fourth quarter of 2023, the Company expects:

Deliveries of vehicles to be between 47,000 and 49,000 vehicles, representing an increase of approximately 17.3% to 22.3% from the same quarter of 2022.

Total revenues to be between RMB16,079 million (US$2,204 million) and RMB16,701 million (US$2,289 million), representing an increase of approximately 0.1% to 4.0% from the same quarter of 2022.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.

Recent Developments

Deliveries in October and November 2023

NIO delivered 16,074 vehicles in October 2023 and 15,959 vehicles in November 2023. As of November 30, 2023, cumulative deliveries of NIO vehicles reached 431,582.

Completion of Offering of Convertible Senior Notes Due 2029 and 2030

In September and October 2023, the Company completed an offering of US$575 million aggregate principal amount of 3.875% convertible senior notes due 2029, and US$575 million aggregate principal amount of 4.625% convertible senior notes due 2030 (the “Notes Offering”).

Shortly after the pricing of the notes, the Company purchased, in separate privately negotiated transactions effected through one of the initial purchasers and its affiliates, approximately US$256 million aggregate principal amount of the Company’s outstanding 0.00% convertible senior notes due 2026 and approximately US$244 million aggregate principal amount of the Company’s outstanding 0.50% convertible senior notes due 2027 for cash, using the net proceeds from the Notes Offering.

The Company plans to use the remainder of the net proceeds from the Notes Offering mainly to further strengthen its balance sheet position as well as for general corporate purposes.

Manufacturing Equipment and Assets Acquisition

On December 5, 2023, the Company entered into definitive agreements with Anhui Jianghuai Automobile Group Corp., Ltd. (“JAC”) regarding the acquisition of certain manufacturing equipment and assets.

JAC is a major state-owned automobile manufacturer in China that currently jointly manufactures with NIO all of NIO’s current vehicle models.

Pursuant to the definitive agreements, the Company will acquire the manufacturing equipment and assets of the first advanced manufacturing base and the second advanced manufacturing base from JAC for a total consideration of approximately RMB3.16 billion, excluding tax.

Launch of the All-New EC6

On September 15, 2023, NIO launched and started deliveries of the All-New EC6, a smart electric coupe SUV.