Aulton New Energy Co Ltd, a leading third-party battery swap solution provider in China, has filed for an initial public offering (IPO) in Hong Kong to raise funds and increase its investment in this sector.

CMB International is the sole sponsor for the Hong Kong IPO, according to a Hong Kong Stock Exchange filing yesterday. The planned number of shares to be issued or the intended fundraising amount has not yet been disclosed.

Headquartered in Guangzhou, Aulton counts Nio Capital as one of its major shareholders, holding a 5.53 percent stake.

The company is a key player in China’s battery swap industry, dedicated to building a portfolio of products and services covering the battery swap ecosystem.

Unlike Nio Inc (NYSE: NIO, HKG: 9866), whose battery swap service currently serves only its own vehicles, Aulton operates as a third-party battery swap solution provider.

Based on revenue generated from battery swap station operations in 2024, Aulton is China’s largest independent third-party battery swap solution provider, it said in its prospectus, citing data from China Insights Consultancy.

Notably, this position may soon be overtaken by CATL (HKG: 3750, SHE: 300750), China’s largest power battery manufacturer.

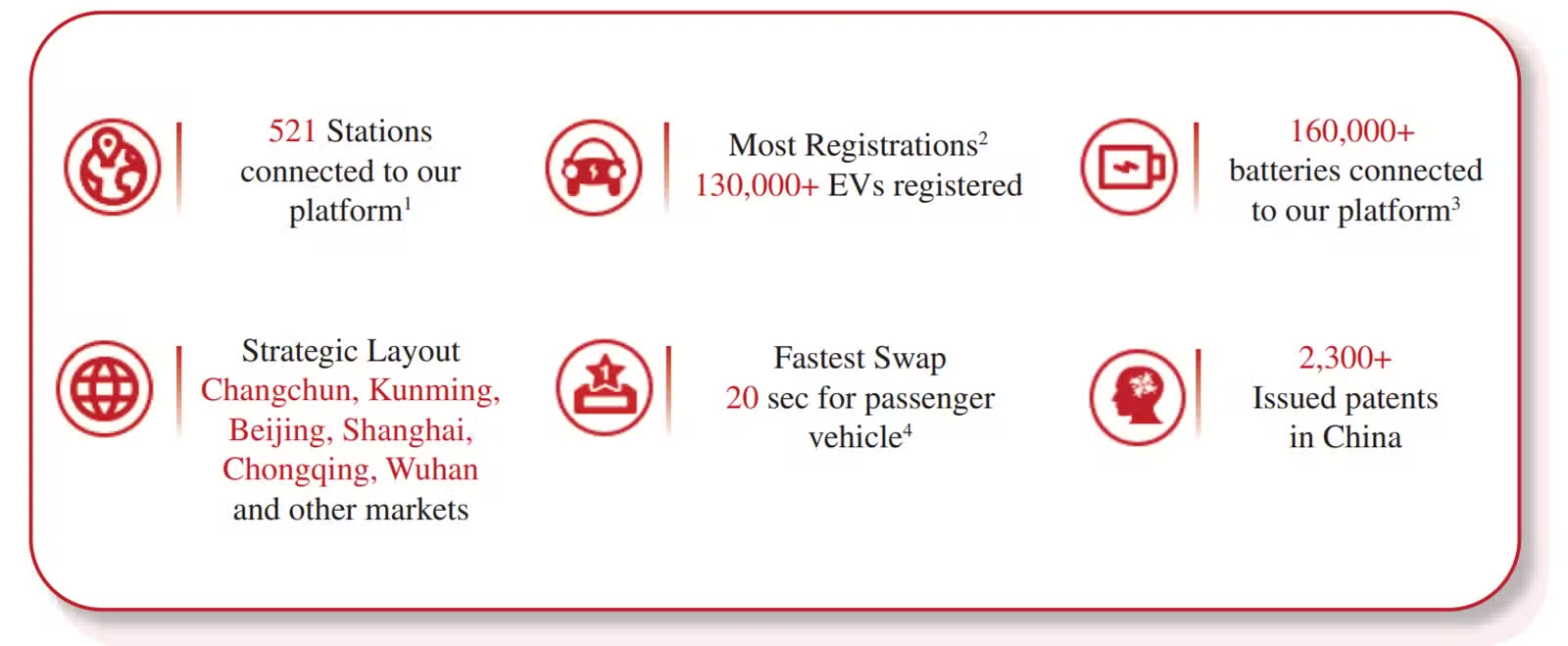

As of June 30, 521 battery swap stations were connected to Aulton’s energy service platform, including 267 company-owned sites, 62 sites utilizing its battery swap operation services, and 192 sites integrated with its platform.

By comparison, CATL’s Choco-Swap battery swap stations reached 925 locations as of December 10, with a target of 1,000 stations by year-end.

Nio currently operates 3,613 battery swap stations in China, serving its own vehicle models.

As of June 30, Aulton’s battery swap system had over 130,000 registered vehicles and more than 160,000 batteries connected to its platform, according to its prospectus.

In the first half of this year, Aulton’s service system averaged 206 battery swap services per day, up from 190 in 2024.

Aulton’s facilities incorporate V2S2G (Vehicle-to-Station-to-Grid) systems, enabling bidirectional energy transfer between EVs and battery swap stations, as well as between stations and the power grid.

As of June 30, eight battery swap stations on Aulton’s platform had deployed V2S2G systems.

In the first half of this year, Aulton’s revenue came in at RMB 324 million ($45.9 million), a 31.7 percent decrease from RMB 474 million during the same period in 2024.

The company recorded a net loss of RMB 157 million in the first half of this year, down from RMB 283 million in the same period last year. Its net losses for 2023 and 2024 were RMB 656 million and RMB 419 million, respectively.

The company plans to use IPO proceeds to iterate battery swap solutions, advance technology R&D, and develop unmanned operation technologies for battery swap stations.

CATL has reached 700 battery swap stations in China, targeting 1,000 stations by the end of this year.

($1 = RMB 7.0552)