This article is being updated, please refresh later for more content.

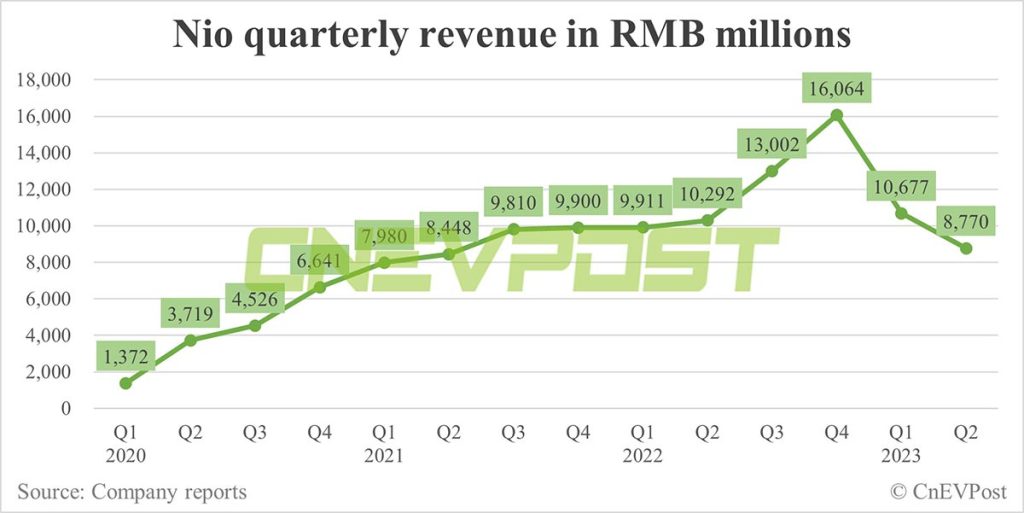

Nio (NYSE: NIO) reported revenue of RMB 8.77 billion in the second quarter, missing market expectations of RMB 9.254 billion, compared with RMB 10.29 billion in the same period last year.

Nio delivered 23,520 vehicles in the second quarter, slightly above the lower end of the company’s previously provided guidance range of 23,000 to 25,000 vehicles.

The company had previously guided second-quarter revenue to be between RMB 8.742 billion and RMB 9.37 billion.

Nio expects third-quarter revenue to be RMB 18.9 billion to RMB 19.52 billion, higher than the market expectation of RMB 17.2 billion.

Nio expects third-quarter deliveries to be 55,000 to 57,000 units, higher than the market’s expectation of 48,465 units.

Its gross margin was 1.0% in the second quarter of 2023, compared with 13.0% in the second quarter of 2022 and 1.5% in the first quarter of 2023.

Net loss was RMB 6,055.8 million (US$835.1 million) in the second quarter of 2023, representing an increase of 119.6% from the second quarter of 2022 and an increase of 27.8% from the first quarter of 2023.

Research and development expenses in the second quarter of 2023 were RMB3,344.6 million (US$461.2 million), representing an increase of 55.6% from the second quarter of 2022 and an increase of 8.7% from the first quarter of 2023.

Below is from Nio’s earnings release, as the CnEVPost article is being updated.

Financial Highlights for the Second Quarter of 2023

Vehicle sales were RMB 7,185.2million (US$990.9 million) in the second quarter of 2023, representing a decrease of 24.9% from the second quarter of 2022 and a decrease of 22.1% from the first quarter of 2023.

Vehicle margin was 6.2% in the second quarter of 2023, compared with 16.7% in second quarter of 2022 and 5.1% in the first quarter of 2023.

Total revenues were RMB8,771.7 million (US$1,209.7 million) in the second quarter of 2023, representing a decrease of 14.8% from the second quarter of 2022 and a decrease of 17.8 % from the first quarter of 2023.

Gross profit was RMB87.0 million (US$12.0 million) in the second quarter of 2023, representing a decrease of 93.5% from the second quarter of 2022 and a decrease of 46.4% from the first quarter of 2023.

Gross margin was 1.0% in the second quarter of 2023, compared with 13.0% in the second quarter of 2022 and 1.5% in the first quarter of 2023.

Loss from operations was RMB6,074.1 million (US$837.7 million) in the second quarter of 2023, representing an increase of 113.5% from the second quarter of 2022 and an increase of 18.8% from the first quarter of 2023.

Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB5,464.1 million (US$753.5 million) in the second quarter of 2023, representing an increase of 132.0% from the second quarter of 2022 and an increase of 20.8% from the first quarter of 2023.

Net loss was RMB 6,055.8 million (US$835.1 million) in the second quarter of 2023, representing an increase of 119.6% from the second quarter of 2022 and an increase of 27.8% from the first quarter of 2023.

Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB5,445.7 million (US$751.0 million) in the second quarter of 2023, representing an increase of 140.2% from the second quarter of 2022 and an increase of 31.2% from the first quarter of 2023.

Cash and cash equivalents, restricted cash, short-term investment and long-term time deposits were RMB31.5 billion (US$4.3 billion) as of June 30, 2023.

CEO and CFO Comments

“NIO delivered 23,520 vehicles in the second quarter of 2023. In July 2023, NIO delivered 20,462 vehicles, representing a substantial increase of 103.6% year-over-year, which propelled NIO to the top position in China’s premium electric vehicle market for vehicles priced above RMB300,000,” said William Bin Li, founder, chairman and chief executive officer of NIO.

“Attributed to the product transition based on the NT2.0 Platform, coupled with the expansion of our power network and the strengthening of our sales capabilities, we expect a solid growth in vehicle deliveries in the second half of 2023,” added Mr. Li.

“In July 2023, NIO closed the US$738.5 million strategic equity investment from CYVN Entities, which demonstrated NIO’s unique values in the smart electric vehicle industry. This transaction further strengthened our balance sheet, powering our continuous endeavors in accelerating business growth, driving technological innovations and building long-term competitiveness,” added Steven Wei Feng, NIO’s chief financial officer.

“Meanwhile, we will remain dedicated to improving our operational efficiency while pursuing continuous growth.” Financial Results for the Second Quarter of 2023 Revenues Total revenues in the second quarter of 2023 were RMB8,771.7 million (US$1,209.7 million), representing a decrease of 14.8% from the second quarter of 2022 and a decrease of 17.8 % from the first quarter of 2023.

Vehicle sales in the second quarter of 2023 were RMB7,185.2million (US$990.9 million), representing a decrease of 24.9% from the second quarter of 2022 and a decrease of 22.1% from the first quarter of 2023.

The decrease in vehicle sales over the second quarter of 2022 was mainly due to lower average selling price as a result of higher proportion of ET5 and 75 kWh standard-range battery pack deliveries and the decrease in delivery volume. The decrease in vehicle sales over the first quarter of 2023 was mainly due to a decrease in delivery volume.

Other sales in the second quarter of 2023 were RMB1,586.5 million (US$218.8 million), representing an increase of 119.9% from the second quarter of 2022 and an increase of 9.3% from the first quarter of 2023.

The increase in other sales over the second quarter of 2022 was mainly due to the increase in sales of used cars, accessories, and provision of power solutions, as a result of continued growth of our users.

The increase in other sales over the first quarter of 2023 was mainly due to the increase in sales of used cars, and provision of power solutions, as a result of continued growth of our users, partially offset by a decrease in revenue from provision of auto financing services.

Cost of Sales and Gross Margin

Cost of sales in the second quarter of 2023 was RMB8,684.8 million (US$1,197.7 million), representing a decrease of 3.0% from the second quarter of 2022 and a decrease of 17.4% from the first quarter of 2023.

The decrease in cost of sales over the second quarter of 2022 was mainly driven by the decrease in battery cost per vehicle and the decrease in delivery volume, partially offset by the increase in cost from sales of used cars, provision of power solutions and sales of accessories.

The decrease in cost of sales over the first quarter of 2023 was mainly attributed to the decrease in delivery volume.

Gross profit in the second quarter of 2023 was RMB87.0 million (US$12.0 million), representing a decrease of 93.5% from the second quarter of 2022 and a decrease of 46.4% from the first quarter of 2023.

Gross margin in the second quarter of 2023 was 1.0%, compared with 13.0% in the second quarter of 2022 and 1.5% in the first quarter of 2023.

The decrease in gross margin over the second quarter of 2022 was mainly attributed to the decreased vehicle margin.

The decrease of gross margin over the first quarter of 2023 was mainly attributed to the increased sales of used cars with lower margin.

Vehicle margin in the second quarter of 2023 was 6.2%, compared with 16.7% in the second quarter of 2022 and 5.1% in the first quarter of 2023.

The decrease in vehicle margin from the second quarter of 2022 was mainly attributed to changes in product mix, partially offset by the decreased battery cost per unit.

The increase in vehicle margin from the first quarter of 2023 was mainly due to decreased promotion discounts for the previous generation of ES8, ES6 and EC6.

Operating Expenses

Research and development expenses in the second quarter of 2023 were RMB3,344.6 million (US$461.2 million), representing an increase of 55.6% from the second quarter of 2022 and an increase of 8.7% from the first quarter of 2023.

Excluding share-based compensation expenses, research and development expenses (non-GAAP) were RMB2,942.9 million (US$405.8 million), representing an increase of 57.1% from the second quarter of 2022 and an increase of 8.5% from the first quarter of 2023.

The increase in research and development expenses over the second quarter of 2022 and the first quarter of 2023 was mainly attributed to (i) the increased personnel costs in research and development functions and the increased share-based compensation expenses recognized in the second quarter of 2023, and (ii) the incremental design and development costs for new products and technologies.

Selling, general and administrative expenses in the second quarter of 2023 were RMB2,856.6 million (US$393.9 million), representing an increase of 25.2% from the second quarter of 2022 and an increase of 16.8% from the first quarter of 2023.

Excluding share-based compensation expenses, selling, general and administrative expenses (non-GAAP) were RMB2,672.1 million (US$368.5 million), representing an increase of 28.3% from the second quarter of 2022 and an increase of 19.3% from the first quarter of 2023.

The increase in selling, general and administrative expenses over the second quarter of 2022 and the first quarter of 2023 was mainly attributed to (i) the increase in personnel costs related to sales functions, (ii) the increase in sales and marketing activities, including the launch of new products, and (iii) increased rental and related expenses related to the Company’s sales and service network expansion.

Loss from Operations

Loss from operations in the second quarter of 2023 was RMB6,074.1 million (US$837.7 million), representing an increase of 113.5% from the second quarter of 2022 and an increase of 18.8% from the first quarter of 2023.

Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB5,464.1 million (US$753.5 million) in the second quarter of 2023, representing an increase of 132.0% from the second quarter of 2022 and an increase of 20.8% from first quarter of 2023.

Net Loss and Earnings Per Share/ADS

Net loss in the second quarter of 2023 was RMB6,055.8 million (US$835.1 million), representing an increase of 119.6% from the second quarter of 2022 and an increase of 27.8% from the first quarter of 2023.

Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB5,445.7 million (US$751.0 million) in the second quarter of 2023, representing an increase of 140.2% from the second quarter of 2022 and an increase of 31.2% from the first quarter of 2023.

Net loss attributable to NIO’s ordinary shareholders in the second quarter of 2023 was RMB 6,121.9 million (US$844.3 million), representing an increase of 123.0% from the second quarter of 2022 and an increase of 27.4% from the first quarter of 2023.

Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB 5,437.1 million (US$749.8 million) in the second quarter of 2023.

Basic and diluted net loss per ordinary share/ADS in the second quarter of 2023 were both RMB3.70 (US$0.51), compared with RMB1.68 in the second quarter of 2022 and RMB2.91 in the first quarter of 2023.

Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per share/ADS (non-GAAP) were both RMB3.28 (US$0.45), compared with RMB1.34 in the second quarter of 2022 and RMB2.51 in the first quarter of 2023.

Balance Sheet

Balance of cash and cash equivalents, restricted cash, short-term investment and long-term time deposits was RMB31.5 billion (US$4.3 billion) as of June 30, 2023.

Share Issuance

On July 12, 2023, NIO issued 84,695,543 Class A ordinary shares to CYVN Investments RSC Ltd in relation to the closing of the US$738.5 million strategic equity investment from CYVN Investments RSC Ltd.

Business Outlook

For the third quarter of 2023, the Company expects:

Deliveries of vehicles to be between 55,000 and 57,000 vehicles, representing an increase of approximately 74.0% to 80.3% from the same quarter of 2022.

Total revenues to be between RMB18,898 million (US$2,606 million) and RMB19,520 million (US$2,692 million), representing an increase of approximately 45.3% to 50.1% from the same quarter of 2022.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.